Accountants

What every SaaS CFO is asking for: the 6 Cs of SaaS finance

For every Board and Executive meeting, tracking your finance key performance indicators (KPI) is critical. But what are the key metrics to guide the long-term sustainability of your company’s operating model? You need to evaluate the financial health of your business, measure the effectiveness of your business efforts and implement changes that correct processes that may be costing you time, resources and money. Successful SaaS FinOps teams understand the importance of calculating investor metrics and leveraging the insights to make informed decisions that help increase your enterprise value.

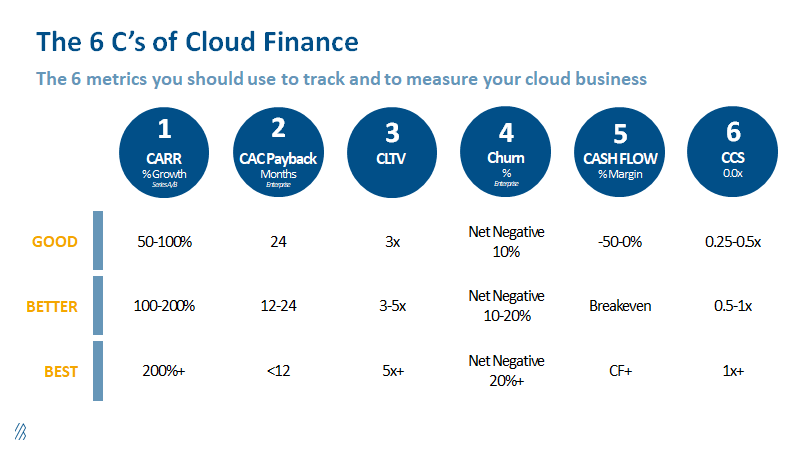

If you own, manage or work for a startup looking to grow and build a viable business, it’s imperative to understand the key drivers of success to show investors how well your company is performing. The 6 Cs of SaaS Finance , according to one of the top SaaS/Cloud investors in the world, Byron Deeter of Bessemer Venture Partners, is the set of measurements that guides what to manage against as you grow your business. While different weights apply to different businesses, they found that these metrics provide accurate “headlights for the business”. Investors can see whether a company’s business model is viable and whether it’s becoming efficient with scale.

In our recent survey in partnership with RevOps Squared and The SaaS CFO, we asked 250 companies about how their financial management processes and metrics measure up against similar company cohorts. Survey results show that many of the top enterprise value impacting SaaS metrics, including Net Dollar Retention, CAC Payback Period and CLTV: CAC Ratio are only calculated 50% – 75% of the time, while other financial statement critical measurements, including EBITDA and Gross Margin are only being calculated 75% – 88% of the time.

According to Byron, the 6 C’s of SaaS finance are a great long-term indicator of overall cash efficiency and business mindset for teams and companies. In today’s volatility, CFOs are trying to find ways to unlock capital and create more value in the long term.

Bryon notes: “By calculating the CLTV/CAC equation, you can see if your customers produce a long-term profit multiple that exceeds the cost to acquire them. It needs to be a meaningful multiple because your cost of capital as a private company or a young public company tends to be very high. And so, the good, better, best framework basically says you need to have at least a 3x payback on each customer you eventually land to have a viable business.”

“Of course, the numbers can be lower and work, [but] not a lot lower. . . because you’re loaning these customers the money and the product early and you’re getting it back over time,” he adds. “Also, if you haven’t calculated your CAC Payback yet, it’s something to focus on now. You want to know the health of your business against the most current lagging and leading indicators.”

These 6 C’s of SaaS finance are the most important SaaS Metrics and what you need to show investors to secure your next round of funding. It allows you to create a comprehensive scorecard for your business and the market-validated good, better, best ratios give you benchmarks to strive for as CFOs.

Want to know where you stand? Compare yourself against the benchmarks in the FinOps Tech Stack Benchmark Survey and see where your peers stand.

Ask the author a question or share your advice