Money Matters

Key bank SaaS survey: four takeaways for finance teams

At fast-growing SaaS companies, CFOs and finance leaders are increasingly viewed as the business-model architects who analyze and guide the organization to successful outcomes. While product teams determine product/market fit, sales leaders maximize high-margin revenue, and customer success teams deliver meaningful and measurable value for clients, it’s finance that leads the way in crafting the successful subscription economics, capital efficiency, and cash flow that drive the business forward.

The 2018 Key Bank Capital Markets Technology Group Private SaaS Company Survey offers a highly valuable set of SaaS metrics for CFOs and their teams on the path to an IPO. Among the several significant trends identified by the KBCM SaaS Survey, there are four critical actions that finance can and should take to guide their businesses. Sage Intacct recently presented these strategies at Sage Intacct Advantage, our annual user conference last month in Nashville. The following blog post distills them further for your SaaS company.

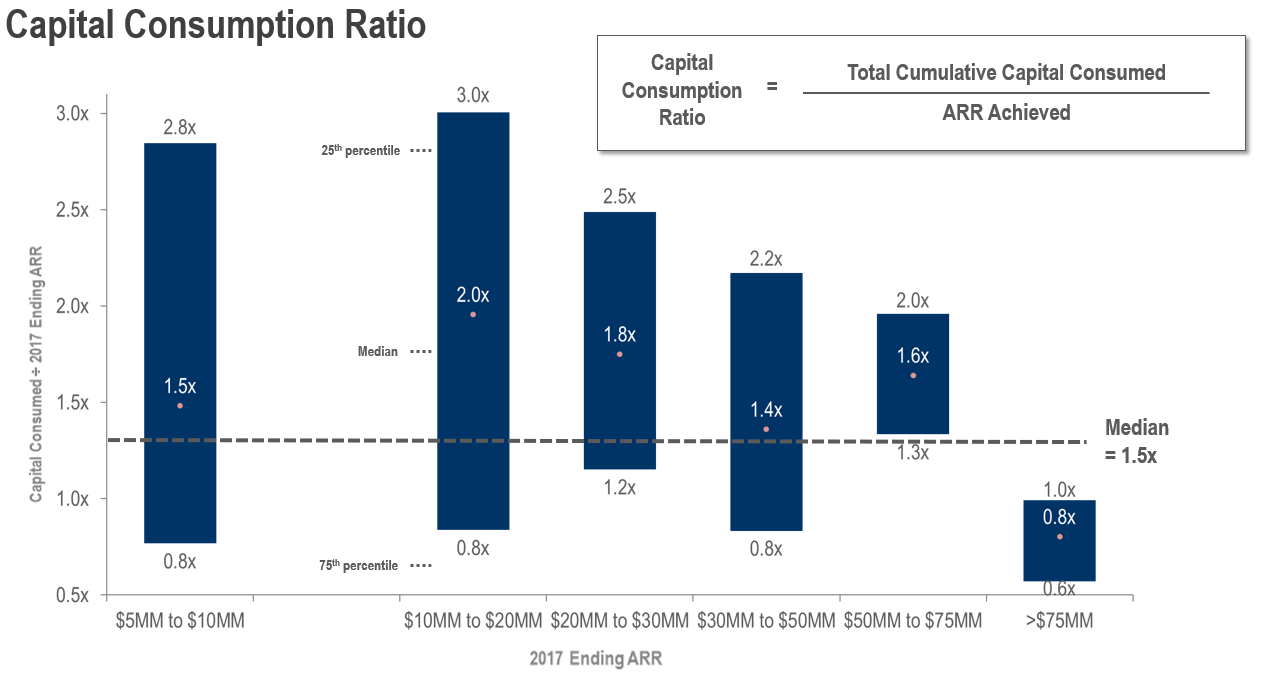

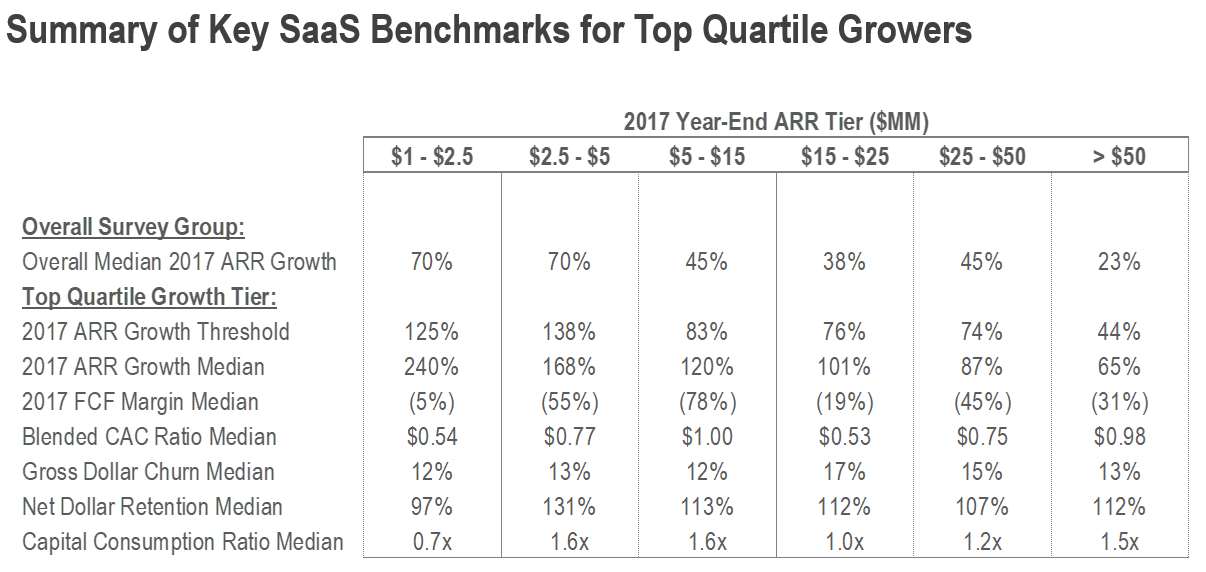

1. Success = High growth and low capital consumption

Capital consumption is the lifeblood of a SaaS business. Key Bank coined this term several years ago to look beyond capital raised and focus on the capital consumed to grow the business. The data shows a median of 1.5x. However the Key Bank Capital Markets SaaS Survey found that the top quartile of performers was <1x Total Capital Consumed / ARR Achieved. In evaluating product/market fit, this is an important quantitative measure that shows how much the market is pulling you vs. how hard you are still working to create the market for yourself. Capital consumption is a critical backward-looking metric for evaluating your subscription business model.

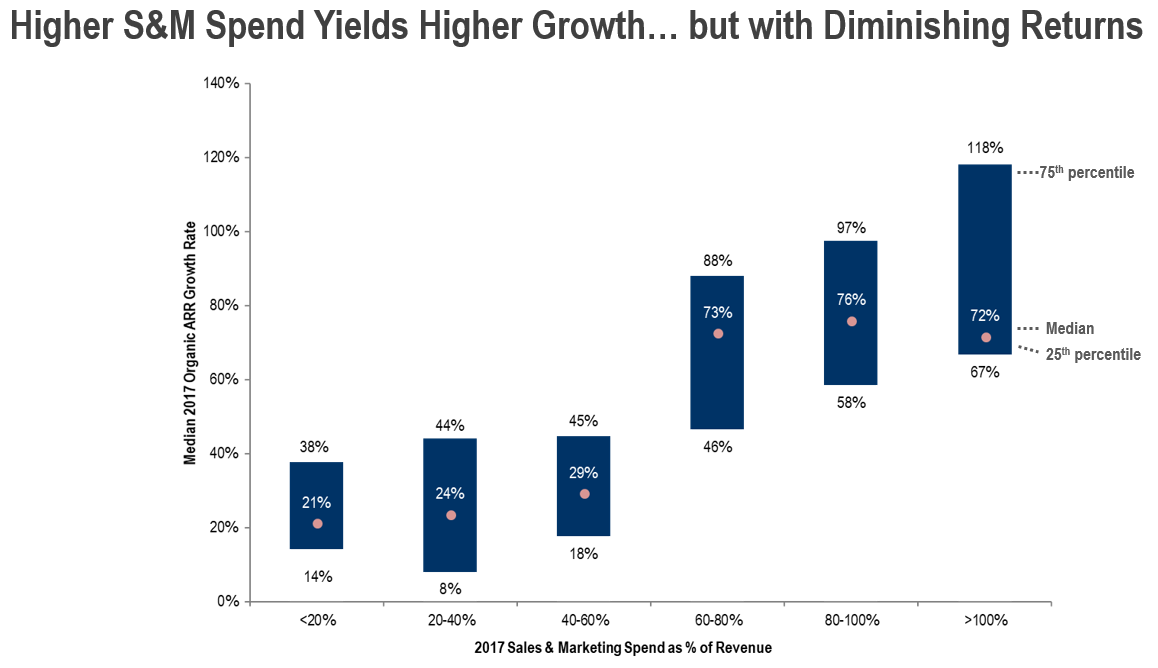

2. Ultra-High Sales and Marketing Spending Doesn’t Always Lead to Growth

KBCM SaaS Survey found diminishing returns in sales and marketing investments. In a subscription business, the return on the sales and marketing spend starts to flatline at 60-80 percent of revenue. Sales, implementation, subscription billing, and customer success processes won’t scale proportionately with sales and marketing costs. This is an important benchmark for planning your SaaS subscription business model and the associated CAC spend.

3. Upselling is the Key to Profitability in Subscription Billing Models

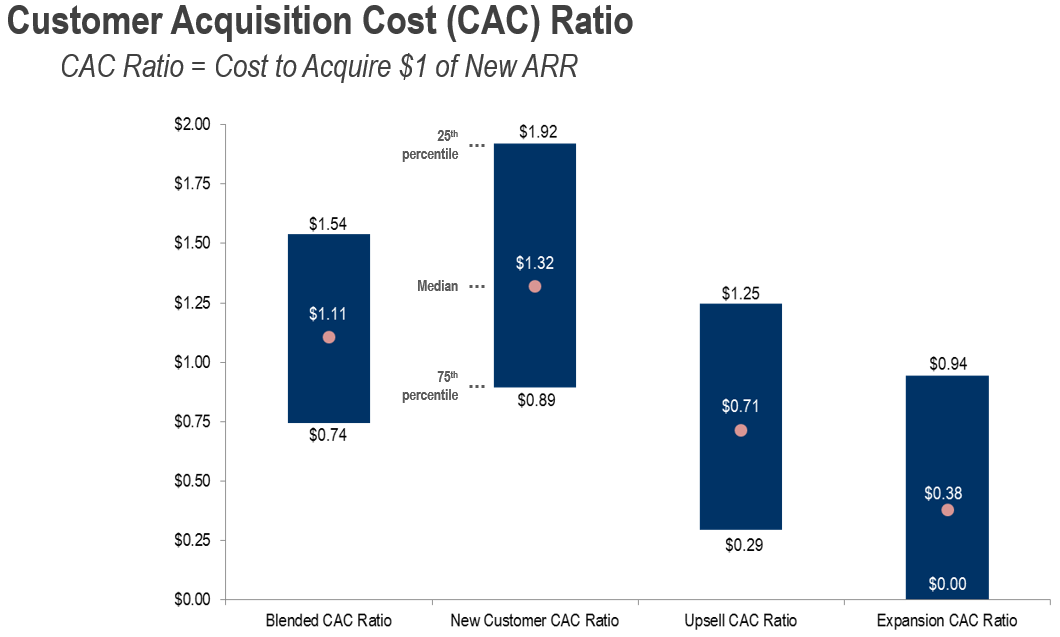

As the first chart below shows, the median cost to acquire $1 of annual recurring revenue (ARR) for a new customer is $1.32. By contrast, using upselling strategies with an existing customer, the cost drops to just $0.71 – just 53 percent of the new-customer cost. Using expansion strategies with an existing customer, the cost is just $0.38 – only 28 percent of the new-customer cost.

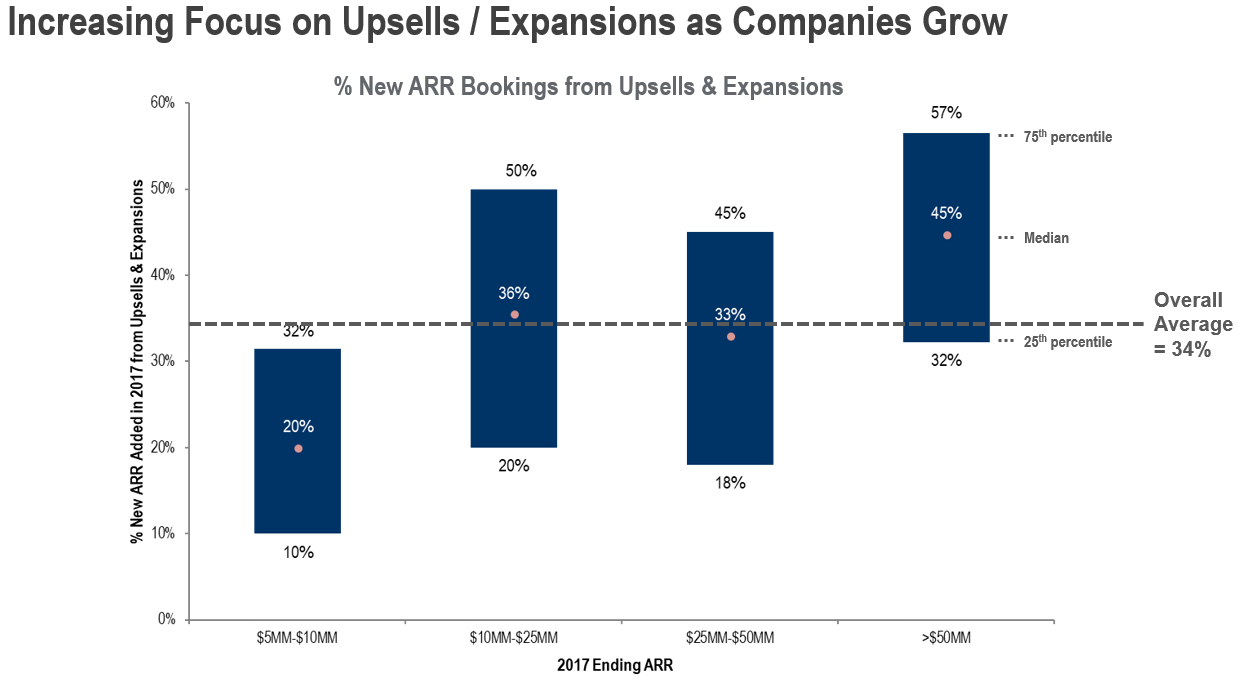

Next, KBCM analyzed the growth stages when companies engage in upsells and expansions, examining the data by revenue range to emphasize the differences. Twenty percent of the companies in the $5-20 million range have embraced these strategies – a great start, and one that reflects the investments that more SaaS companies are making to achieve a single view of all of their contractual subscription billings and obligations to drive the business.

Next, KBCM analyzed the growth stages when companies engage in upsells and expansions, examining the data by revenue range to emphasize the differences. Twenty percent of the companies in the $5-20 million range have embraced these strategies – a great start, and one that reflects the investments that more SaaS companies are making to achieve a single view of all of their contractual subscription billings and obligations to drive the business.

4. Go-to-Market Choices have Consequences

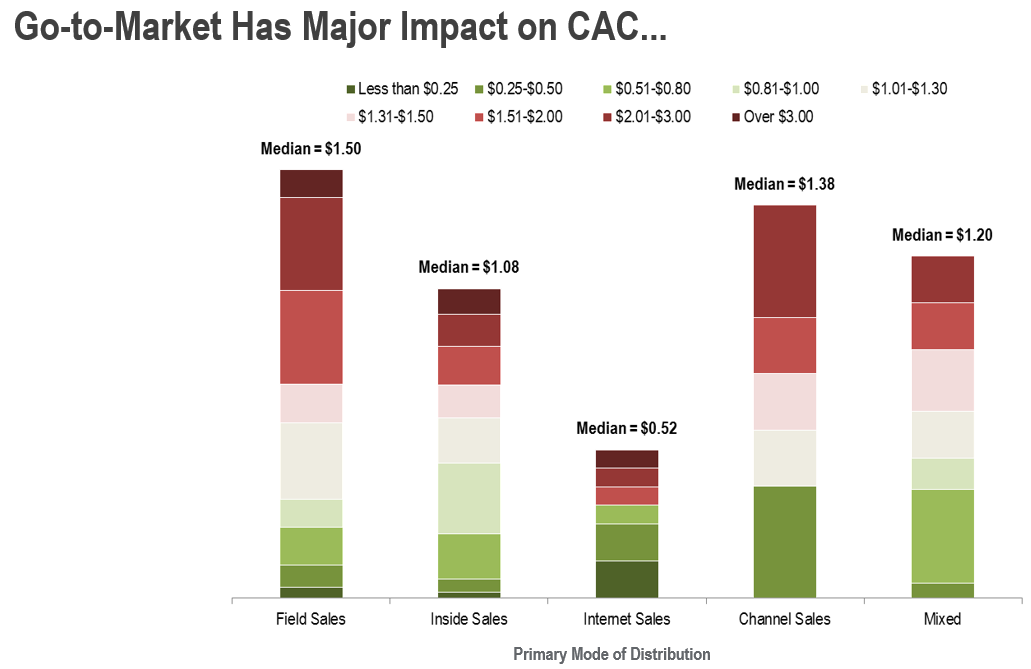

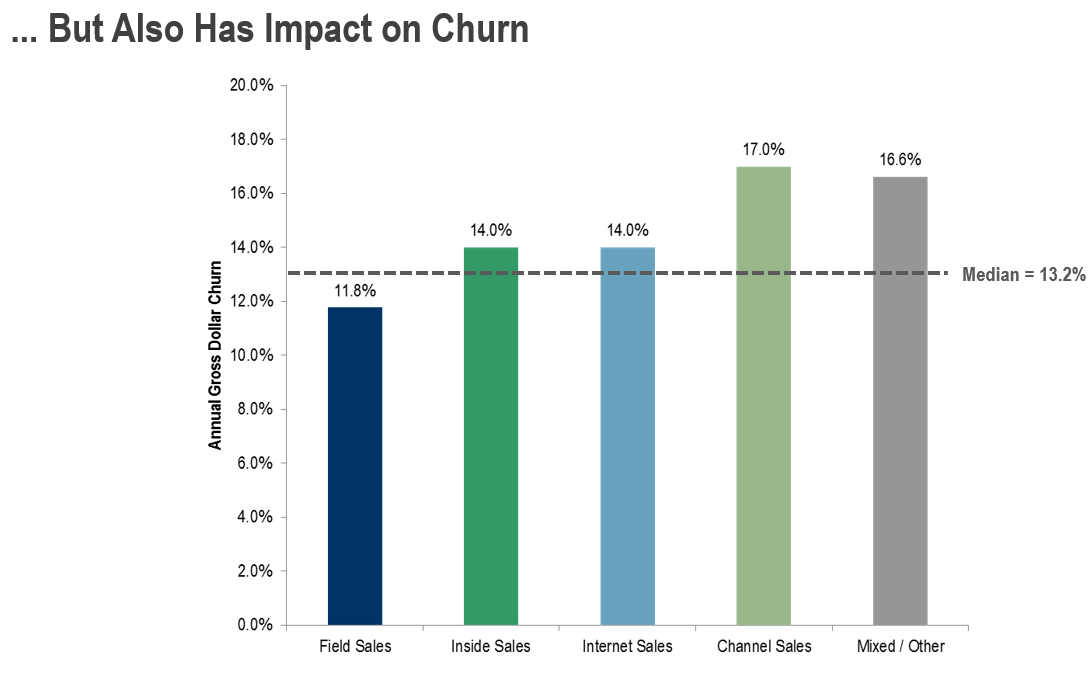

The following three charts highlight the major impact that go-to-market strategies have on customer acquisition costs (CAC). The differences between field sales and inside sales reflect the tradeoffs between lower cost, ACV, and stickiness.

The following chart compares the two dominant models – inside v. field. Note the differences in sales and marketing costs, ACV, churn, and retention.

The following chart compares the two dominant models – inside v. field. Note the differences in sales and marketing costs, ACV, churn, and retention.

Conclusion

These four SaaS metrics that successful SaaS businesses monitor help CFOs see the forest, not the trees when making decisions. There are many choices, but which ones optimize capital consumption to drive the business? Data is better than opinions, and metrics are better predictors than simply the loudest voice in the room.

The real trick for SaaS CFOs and business-finance leaders is to get this data – and get it in time to act faster than competitors. Sage Intacct enables finance teams to move from data historians into business-model architects across GAAP and Saas metrics.

Ask the author a question or share your advice