Money Matters

Giving USA 2022: 5 surprising stats about nonprofit giving

Each year, Giving USA Foundation™ publishes its Annual Report on Philanthropy. Going back to 1956, it is the longest running annual report on U.S. charitable giving.

Giving USA 2022 provides valuable insights into how dollars are flowing through the nonprofit sector. In this article, we will examine a few of the surprising findings from the report and the potential impacts and implications of changing trends in donors, dollars, and recipients.

Download the e-book, Nonprofit Storytelling: Using Data and Performance Metrics to Motivate Donors.

1. Overall giving went up, but inflation rose faster

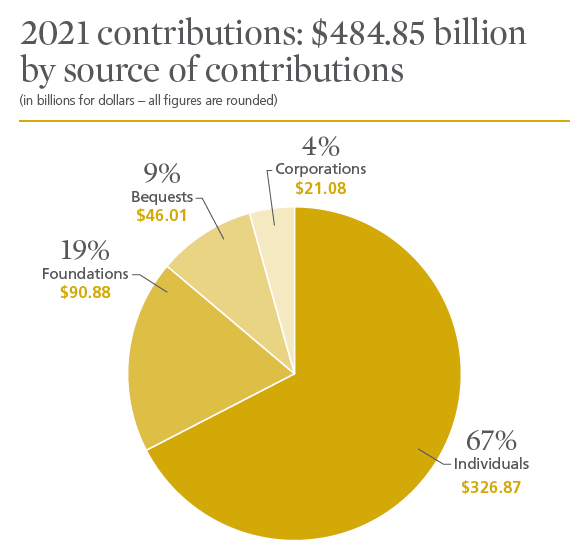

First, the good news: Charitable contributions in 2021 totaled nearly $485 billion, setting a new record high. This was a 4% increase from $466 billion in 2020—the previous record.

Now for the bad news: When adjusted for 2021 inflation, contributions actually declined -0.7%. And with the blistering pace of inflation picking up speed in 2022, next year’s report may very well deliver similar setbacks.

The bottom line: As an industry, nonprofits are enjoying record-setting and growing charitable contributions. But inflation is eating away the value of donated dollars, resulting in (so far) a small decline in real growth. In these situations, strong financial management becomes central to organizational success.

“Using custom dimensions in Sage Intacct to track costs, we identified $200,000 in logistical savings, which enabled us to provide essential vitamins and minerals to an additional 800,000 undernourished pregnant women and children.”

Bonnie Forssell, CFO, Vitamin Angels

2. Individual giving increased, but there is a catch

The Giving USA report shows that giving by individuals grew to nearly $327 billion in 2021, up from $324 billion in 2020. On the surface, that looks like American households are in good financial shape and making donations. But under the surface, all is not well with giving within middle-income households. From 2000 to 2018, the proportion of households giving to nonprofits dropped from 66% down to under 50%, according to the Gilded Giving 2022 report by the Institute for Policy Studies.

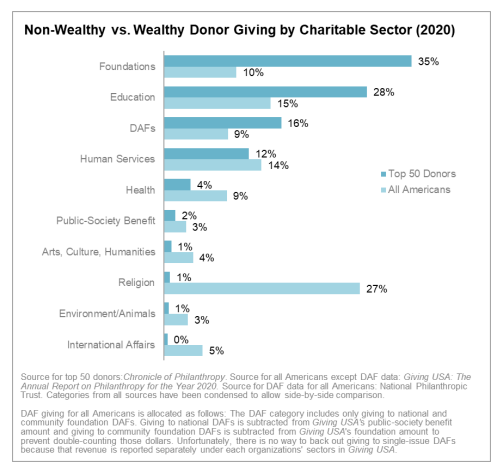

In 2019, households earning more than $200,000 annually contributed 67% of all charitable donations, up from 25% in the 1990s. Those earning $1+ million accounted for 40% of charitable donations. Ultra-wealthy donors hold even more influence over nonprofit mission priorities as mega-gifts grew from a total of $2.7 billion in 2011 to $14.9 billion in 2021.

The wealthiest philanthropists give overwhelmingly to foundations and donor-advised funds (DAFs). Of the $25 billion in identifiable gifts donated in 2021 by the Forbes Top 50 Philanthropists, $17+ billion was given to private foundations and $2.6 billion to DAFs, representing roughly 80% of their total gifts.

The bottom line: Nonprofit organizations must embrace a diverse mix of funding sources to achieve mission success. Small individual donations may continue to decline as a share of total giving. As the third largest recipient of donations and the second largest source of nonprofit funding, foundations are changing the landscape. Thus, organizations need to improve their ability to win, track, and manage grants to achieve growth. Effective grant tracking and billing software is often required; in most cases, spreadsheets are not up to the task.

“Cash is king in our world, and with Sage Intacct’s outstanding ability to handle our grant management needs, we now have a real-time view of all our assets and what’s driving our revenues—which wasn’t possible with the cumbersome Excel-based process we used before.”

Michael Mohr, CFO, Women’s World Banking

3. Giving to foundations and by foundations reached new heights

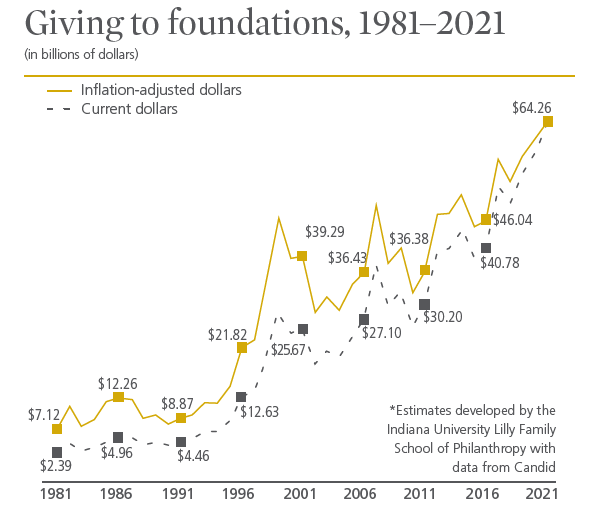

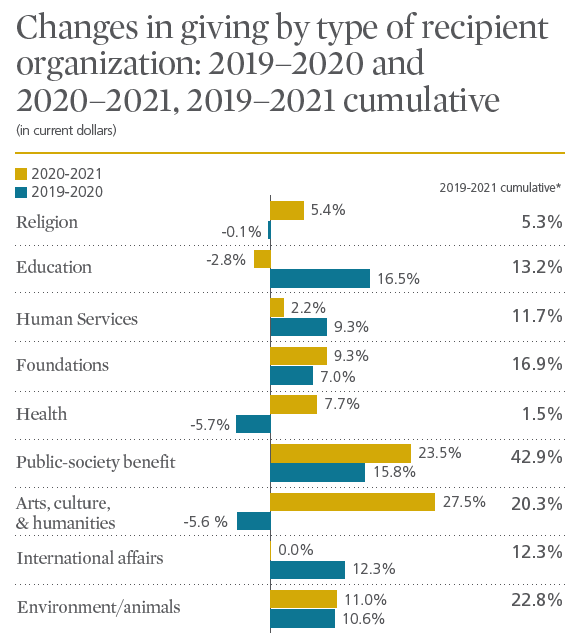

Over the past 40 years, foundations have become significant recipients of charitable dollars and an important funder for other nonprofits. In 2021, independent, community, and operating foundations received just over $64 billion, more than any time since 1981. This was up 9.3% from 2019, or 4.4% when adjusted for inflation. Foundations received 13% of the total giving across the industry and ranked third place (tie) in percentage of total contributions.

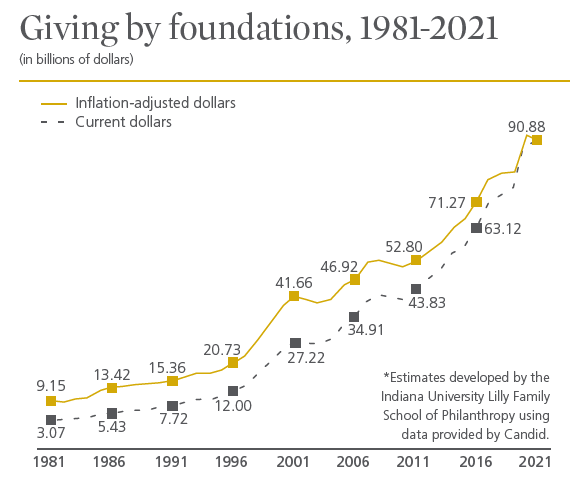

At the same time, foundations have become the second largest source of U.S. charitable donations—nearly one in five charitable dollars flows out of foundations. Foundations made grants worth nearly $91 billion to nonprofits in 2021. Adjusted for inflation, foundation giving slightly declined by -1.2% in 2021.

The bottom line: Foundations are well-funded and will continue to be responsible for an increasing amount of nonprofit spending. Transparency with major donors and grantees is important. Foundations need cloud nonprofit accounting software to deliver real-time visibility, streamline accounting tax and audit processes, and automate reporting.

“Sage Intacct lets us do so much more than we could before, and our team’s productivity jumped 40% as a result. We’re no longer using brain space on tasks we can automate, so we click fewer buttons and make more judgment calls instead.”

Jennifer Mitchell, Accounting Manager, The Ford Family Foundation

4. Biggest increase in donations went to arts, culture, and humanities

Year-over-year giving to Arts, Culture, and Humanities rose 27.5% (22% after inflation), after declining between 2019 and 2020. This was the largest increase of any subsector in 2021. Arts, Culture, and Humanities received the eighth largest chunk of charitable contributions in 2021, at 5% of total giving. This is consistent with a four-decade trend of three to five percent of all charitable dollars flowing to the arts.

The bottom line: After declining contributions during the first year of the pandemic, the Arts, Culture, and Humanities subsector enjoyed the strongest growth of any part of the nonprofit industry in 2021. However, the trend over time has been consistent at less than five percent of all nonprofit charitable donations. Therefore, Arts, Culture, and Humanities nonprofits have to operate very efficiently so they can grow their missions without growing overhead and staff expenses. Cloud-based nonprofit accounting software can slash IT costs, empower work from home, and integrate with the best-in-class solutions relied on by these nonprofits.

“We’ve been able to close the month 60% faster since rolling out Sage Intacct and connecting it with our other software [Adaptive Insights for budgeting and Nexonia for expense management]. We produce financials and push information out to our stakeholders a lot quicker and with more detail, so they’re not waiting a month to see how we’re performing.”

Chris Safford, Finance Director, Yerba Buena Center for the Arts

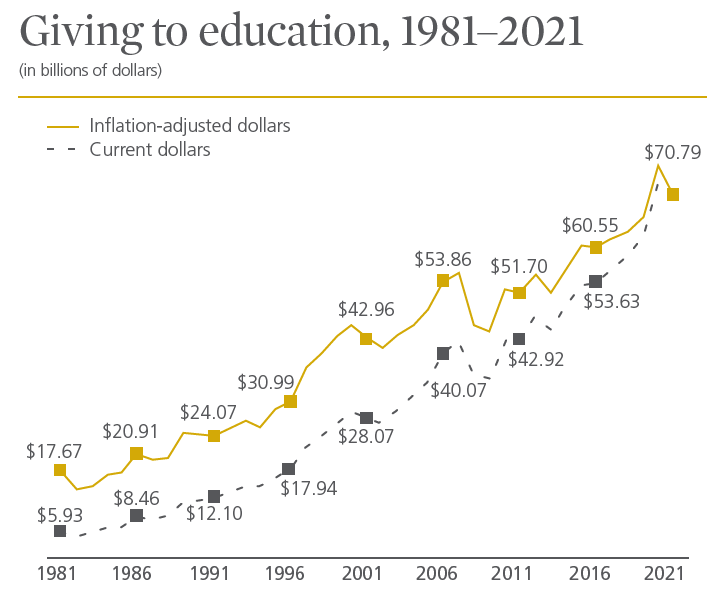

5. Education was the second largest recipient of donations

As has been the case for decades, the largest share of 2021 donations flowed to religious nonprofits. Education received the second largest share of dollars, at 14% of total donations in 2021. Although giving to education declined a bit (-2.8%) from 2020 to 2021, it had previously increased 16.5% between 2019 and 2020. So, the cumulative change in dollars from 2019 to 2021 was 13.2%, indicating very strong growth for this subsector.

The bottom line: Donors are investing in educational nonprofits. From private, charter, and higher education institutions to new education trailblazers, educational nonprofits need to demonstrate high degrees of accountability to parents, alumni, and other donors. Dashboards and automated reporting help education nonprofits ace the stewardship test.

“Sage Intacct has been the perfect solution for our needs, and the mindset across our organization has completely changed since we made the switch. Now everyone has visibility into their spending and knows immediately if their budget starts to go negative, so there’s real ownership by department managers.”

Roberta Hopkins, CFO, Georgetown Visitation Preparatory School

Nonprofits need to improve mission storytelling to grow funding

The statistics presented by Giving USA this year highlight the need for nonprofits to remain resilient and adapt to changing funding trends. They need real-time visibility into funding, expenditures, and outcomes in order to make data-driven decisions. Financial performance data and outcomes metrics should be woven into the mission success story nonprofits share with their donors.

Discover how cloud financial management technology can help spotlight your organization’s success and adapt to trends in giving. Download the Nonprofit Storytelling: Using Data and Performance Metrics to Motivate Donors e-book to get more best practice tips for using data and metrics to motivate donors when telling your mission story.

Ask the author a question or share your advice