Growth & Customers

From financial reporting to data visualization, a needed switch to drive organizational growth

As companies digitize their financial processes, they are accumulating enormous amounts of data about operations and customers. The point of collecting this information is to provide insights that leaders and teams can use to make better decisions.

As a result, visual reporting is gaining momentum. Foundry’s 2021 Data and Analytics survey found that 69% of organizations are piloting or using visual dashboards and data visualization tools to consolidate and share information. By 2025, data stories will be the most widespread way for organizations to consume analytics, according to Gartner.

“Portraying financial data in a user-friendly way allows people to discover connections they wouldn’t have seen otherwise,” says Scott Freedman, director of marketing at Sage Intacct. “With that information, they can make decisions that improve the business.”

But at many organizations, this new type of reporting has yet to gain traction: Over half of finance departments struggle to provide data and reports stakeholders can rely on to inform their decisions, according to Gartner.

Data is only useful when people can easily find it, understand it, and put it to work. When it’s buried in spreadsheets and scattered across departments, teams often don’t know where to look for it. Searching takes up valuable time, and the numbers teams find often lack context.

“Data is too often siloed and represented in ways that don’t allow people to slice and dice it the way they need to,” says Freedman.

In addition, spreadsheets can’t keep up with real-time operations. “They are stuck in time,” Freedman says. “They show recent or long-term past performance, but not the real-time reporting you need to predict the future.”

Frustrated by the inability to use their data effectively, management teams are turning to new solutions that collect data across the business and present it in customized dashboards. The dashboards don’t just display facts and figures. Instead, they create a narrative that places the data in context, along with graphical depictions that help bring it to life. Finance leaders and teams can easily filter the information to learn what’s working and what’s not, and then using these insights to improve operations or find new revenue opportunities.

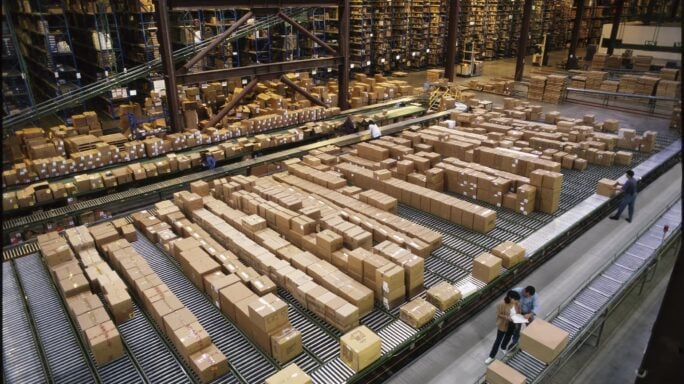

For example, Quicksilver Express Courier, a “last mile” delivery service, collected all kinds of data about its fleet, but lacked visibility about individual vehicle profitability. After adopting Sage Intacct, Quicksilver’s finance executives were able to drill down into the profit and loss for each truck. As a result, the company learned it was overpaying for workers’ compensation insurance, and subsequent adjustments saved $100,000 a year. Other changes based on insights Quicksilver gained from the platform helped the company increase total profitability at some of its locations by 5% to 25%.

Case Study - Quicksilver Express Courier

Delivery firm boosts profitability with breakthrough insights and efficiencies gained in Sage software

In addition to improving business results, sharing information through customizable dashboards helps executives better communicate with their teams. Reports don’t necessarily show why results are important, but presenting them in a narrative with visual illustrations explains them more effectively and makes leaders’ recommendations more meaningful and convincing.

Teams can experiment with their dashboards, using real-time information, charts, and graphs to try out ideas for improving processes or services. “You can look backward or forward and use real-time insights to predict future results,” Freedman says.

Learn more about Sage Intacct by attending one of the daily Coffee Break Demos.

Ask the author a question or share your advice