Money Matters

Finance and HR – new allies in the economic recovery effort

The concept of a BFF (best friend forever) appeared circa 1996. While it’s a common abbreviation in social media circles, it may now apply to two back office groups that are now closer than ever: Finance and HR are now joined at the hip. And, it only took a pandemic for it to happen!

The Historic Collaboration Between HR and Finance

Periodic connections have always been present between HR and Finance. The Payroll to General Ledger interface after every payroll run may be one of the most frequent of these interactions. That interface is often an automated event whose results must still be adjusted to account for issues like a worker that was assigned to one legal entity but loaned to another for some portion of the payroll time period.

During the annual planning cycle, many estimates are needed for future accounting periods. Finance may need information re:

- Headcount

- Salaries, wages, benefits cost

- Retention/attrition rates

- Training costs

- Onboarding expenses

- Recruiting expenses

Providing this data by a legal entity, geography, product line, accounting period and other dimensions requires great systems, past history and data analytics. And it takes time.

Finance will further analyze this planning data to better understand office space requirements, update cost accounting standards (e.g., plant overhead costs), reconcile headcount with sales plans and production estimates, etc.

Finance and HR also have to react to a number of corporate changes. If the company does a reorganization, adds a new benefit mid-year, changes its accounting calendar, or makes an acquisition or other material event, there will need to be a number of joint discussions to get all of these changes into the respective systems correctly and in a timely manner.

The best cooperation between Finance and HR can occur when both share a number of the same systems. But now, more cooperation is needed.

Where Finance and HR cooperation is Now Mandatory

Current events have altered the relationship between Finance and HR with both groups leaning on each other more. The universe of joint activities though depends a lot on where each firm exists. Some firms are still dealing with very immediate and continuing challenges related to the pandemic. Other firms are already in a stabilization mode while a third group is moving ahead through growth-oriented activities. Regardless of the stage they’re in, Finance and HR must jointly address issues such as:

- Plans – Businesses that generated plans/forecasts once a quarter or once a year are now re-planning as often as 2-3 times per week. What’s in these plans? Headcount estimates are being used to calculate a number of costs such as PPE costs, new safety protocol training costs, WFH (work from home) equipment costs, etc.

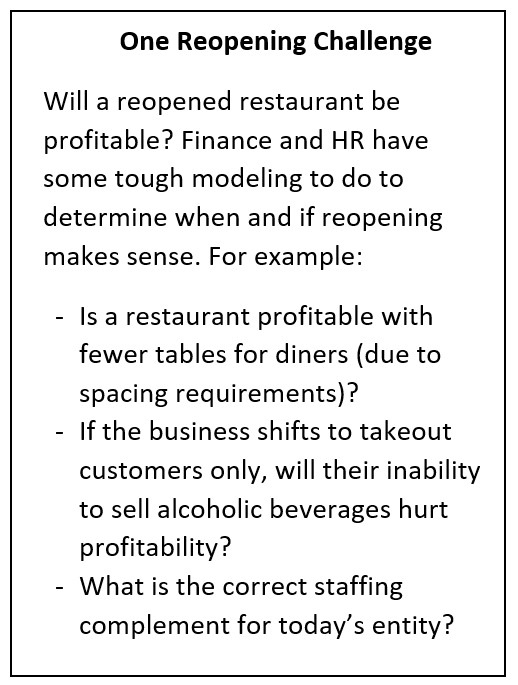

- Reopening plans – To reopen some or all of a business is not a trivial task. Finance must budget for new safety

equipment (e.g., Plexiglas shields between workers), new payment technology (e.g., touch n’ go credit card readers), etc. HR must inform Finance as to how many furloughed workers will/won’t return and what it will cost to (recruit replacements and) onboard these personnel. Finance and HR will need to answer questions like:

equipment (e.g., Plexiglas shields between workers), new payment technology (e.g., touch n’ go credit card readers), etc. HR must inform Finance as to how many furloughed workers will/won’t return and what it will cost to (recruit replacements and) onboard these personnel. Finance and HR will need to answer questions like:

- Will workers return if the federal government is still paying an extra $600/week in unemployment benefits?

- Will workers return to a reduced work week (and pay)? A surprising number of laid off workers might not return especially if their new pay is less than their unemployment benefits checks.

- Will workers return for less than their original wages and benefits? Can Payroll and HR model this? Do they need survey/engagement tools? How will they contact laid off workers?

- Employee, contractor, supplier and customer safety – The safety of all of these different constituent groups has often been an operations or facilities management issue. However, the enormity and scope of this matter involves Finance and HR in material ways. Finance has to understand the implications of personal spacing on floor space requirements and the need for specialized safety equipment. These things cost money and a failure to attend to them well could result in expensive litigation or health insurance claims. HR must understand the impact of these same issues on the workforce and others who visit your facilities. Does HR know who all of the contract/contingent workers are and what access they have to your firm’s facilities? Who will ensure that contractors, suppliers and customers have appropriate PPE and are trained on the company’s new safety protocols?

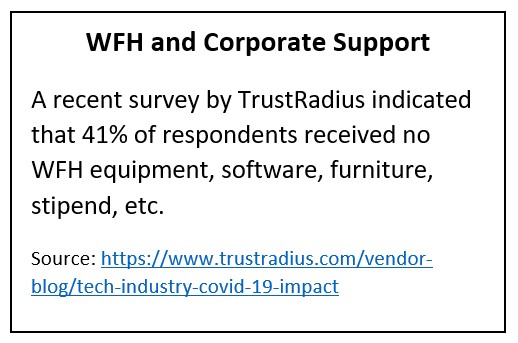

- Long-term planning concerns – If WFH becomes a more permanent part of your firm’s work environment, will Finance want to reduce your leased office space requirements? How will HR adjust Performance Reviews and other processes for those workers who are rarely seen in the office going forward? Are remote workers lacking in critical productivity tools and who will acquire the budget for these tools? Does Finance know where all of the firm’s technology assets and software subscriptions are given the rush to WFH?

- Workforce productivity – This must be a top-of-mind matter for both Finance and HR leaders. Some WFH

experiments in certain parts of the world were not successful as companies had insufficient numbers of laptops, lacked remote access software and employees’ homes lacked high-speed internet access. The problem was exacerbated if the company lacked robust collaboration and video conferencing tools. This loss of productivity has a cost and Finance will want to dig into this. HR will need to understand what is and isn’t working in all manner of business processes, not just HR processes especially if WFH continues in some fashion long-term.

experiments in certain parts of the world were not successful as companies had insufficient numbers of laptops, lacked remote access software and employees’ homes lacked high-speed internet access. The problem was exacerbated if the company lacked robust collaboration and video conferencing tools. This loss of productivity has a cost and Finance will want to dig into this. HR will need to understand what is and isn’t working in all manner of business processes, not just HR processes especially if WFH continues in some fashion long-term. - Tax nexus issues – This is one thorny, murky area. If workers were required to work from home by government order, it may not necessarily create new payroll and corporate tax issues. However, if individuals continue to work from home after travel or other sanctions are lifted, it could create a number of new tax nexus/liability issues for both Finance and Payroll. Are appropriate employment and use taxes being withheld for the new tax jurisdictions? Modeling this issue will be time-consuming, and possibly a case-by-case exercise.

- Travel – Travel costs (and to a lesser extent relocation costs) are a big expense line item in some industries (e.g., software implementation firms). While it’s easy to determine what travel can cost during a lockdown (almost nothing), planning for future travel costs will be more challenging. HR will doubtlessly field a number of queries from people who will be uncomfortable flying until a vaccine is found and is widely in use in the global population. Can the firm make them fly before then? How do you model this cost?

What is helping the BFF situation

The best Finance/HR relationships appear to be in companies where the Finance and HR software is public cloud based, accessible via mobile devices and connected to great collaboration and planning tools. These tools not only permit team members to work from home, they should also provide answers fast. Real-time, multi-tenant solutions have recently shone brightly in this regard.

In contrast, on-premises solutions and standalone (i.e., not fully integrated) Finance and HR technologies were challenges to the personnel in both groups. If a firm had a tough time before the pandemic knowing how many employees, contractors, etc. it had, it was really hard to figure that out during this crisis. And, if you don’t know your headcount, you can’t understand their costs or provide for their safety.

Closing Thoughts

The successes of Finance and HR groups are more connected and dependent upon each other than ever. While periodic connections have always been present, recent events have demanded more data, more estimates, more scenario planning, etc. than ever before. All of that work requires collaboration and communication. But it works best when both groups share similar technologies, in the cloud and in real-time. While pundits have regularly predicted that the days of information islands, paper, spreadsheets and siloed application software are over, this pandemic may have finally convinced the last doubters that this true.

It also bears noting that HR and Finance must understand financial AND soft-side issues involving employees. There are home economics, social sciences, regulatory and other issues at play (e.g., what about employees who must remain at home to home-school their children due to mandated school closures. Does this create new, unintended tax issues?) As new issues arise both Finance and HR will need to research and recommend a unified policy for the firm to adopt. Separate or conflicting strategies are unproductive and inefficient. Great leaders in each discipline must find fast, effective and fair solutions as the need for the same becomes apparent. And, they must reach these decisions together so that they present a consistent unified set of messages, decisions and policies to employees and other constituents.

This tighter cooperation between Finance and HR may stay. While it may lose a smidgen of its urgency or intensity in time, the pace of change in the global economy will likely trigger more chaos or dynamism. The best firms should count on these two groups needing to work and plan together more.

It also holds that Finance and HR will have to have a seat in future contingency plans, disaster recovery plans and scenario planning efforts. This is in addition to the traditional business plans and planning cycle activities.

It’s a different time in the back office and it requires a different approach to problem-solving, a better toolset for both Finance and HR, and, the leadership to make it happen. It’s time to act!

Ask the author a question or share your advice