Accountants

Audit-ready financials expedite nonprofit audits and enhance transparency

To advance your nonprofit’s mission and drive long-term success, it’s important to focus on building and maintaining your reputation. However, today’s 24-hour-news-cycle amplified by social media sharing of stories about fraud, malfeasance, and poor financial leadership means nonprofit organizations must be extremely diligent about stewardship.

Nonprofit organizations already face increased competition for funding and greater donor scrutiny of operations. As a consequence, the nonprofit audit serves an important role in transparency.

Regular audits not only provide insight into the financial health of your organization, they also serve to reassure donors and other stakeholders. In fact, audits provide confirmation of your organization’s accountability and compliance. While not all nonprofits are legally required to conduct an audit, there are many reasons why they should be a priority—especially for larger nonprofits with more than $250,000 in funding.

What’s involved in a nonprofit audit?

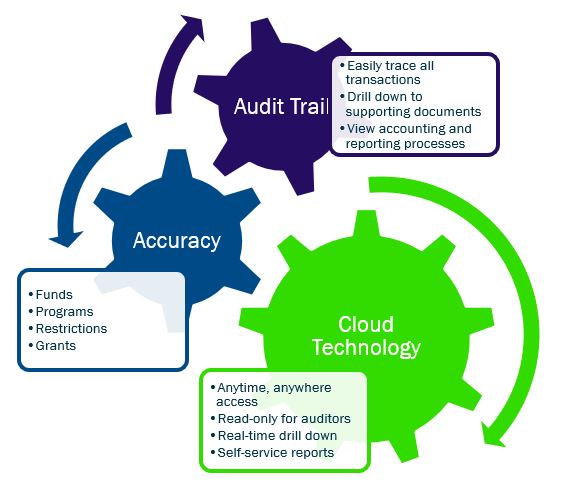

A nonprofit audit consists of a review of GAAP-compliant financial statements and a separate compliance audit to assess risk and controls. For any nonprofit, the key to audit readiness is having well-documented transactions and balances. Find out how you can better organize transactions and establish a clear and complete audit trail from transaction to report and reconciliation. See how cloud nonprofit accounting software embolden auditors to quickly and effectively test your nonprofit’s accounting processes.

Get organized to achieve an expedient, cost-effective nonprofit audit

The goal of an audit is to focus on the riskiest area of a nonprofit’s financial statements. Unfortunately, if the organization’s statements aren’t well documented or audit-ready, auditors spend too much time in the weeds trying to sort through records or unravel day-to-day accounting processes. That’s why many nonprofits are using a modern nonprofit financial management system to organize transactions and produce audit-ready financials. Using modern cloud accounting software, you and your auditor will save time verifying financial processes and statements. During the risk assessment process, an auditor will test your accounting and reporting processes by:

- Checking calculations

- Examining records to support balances and transactions

- Confirming certain balances and transactions with third parties

- Verifying assets

“Sage Intacct cut days from the time we spend preparing our financial reports, and often saves weeks in the process of preparing schedules for our audits and tax returns.”

Monica Emerson, Controller, Conrad N. Hilton Foundation

With cloud financial management software, you and your auditor can view any transaction and its supporting documentation quickly and easily. Transactions can be easily traced from the financial statements to the general ledger to the sub-ledger to the supporting documents, and back again.

A positive audit experience starts with organization. Using a financial management system that is purpose-built to manage the accounting path not only saves time by streamlining processes, it also provides quick and easy access to complete audit trail information. This allows auditors to easily and effectively test your organization’s accounting processes.

Automation drives time and cost savings

Cloud accounting software speeds up accounting period closes by leveraging automated calculations and eliminating the inefficiencies and inaccuracies associated with manual spreadsheets. Modern cloud accounting software streamlines and automates:

- The organization of funding sources

- The documentation of accounting treatments

- The calculation and reconciliation of all figures

- The closing and consolidation of the books

- The preparation of financial statements

“One of the things that we do is give our auditor a view only access to our Sage Intacct system. He can go in and, if he wanted to, audit every single transaction. He doesn’t do that, but it’s there. It cuts down on the time I need to spend with him on audits. He’s got the access and it makes our audit go so much quicker. I can do an audit in one week with Sage Intacct. Can you believe it? A week. That is huge!”

Donna Dickt, Executive Director, NATCO

Plus, your organization can provide your auditor with read-only anytime, anywhere access to transaction details and self-service reports. Starting with the financial statement, your auditor can click on any figure and drill all the way down to the general and sub-ledgers, reports, reconciliations, and original transactions to test key accounting processes. Moreover, built-in flexibility enables you to close a sub-ledger before you close the full general ledger so that your auditor can start looking at risky areas like receivables sooner. Your auditor doesn’t have to wait for the entire financial close process to be complete. As a result, they have more time to test higher risk areas.

Automation also enables auditors to run built-in reports and reconciliations on demand. This self-service model allows audit investigations to occur in the background, speeding up the audit. Auditors can find and locate the documentation they need, without the need to come to you with questions.

When auditors can do their work with speed and efficiency, it can reduce the overall cost of your audit. If auditors can work remotely, you’ll have less disruption at the office. By empowering auditors to find the data they need without asking questions or requesting additional reports, your finance team can stay more productive throughout your audit.

Conclusion

Conducting an audit is an important way to show donors and other stakeholders your nonprofit organization excels in financial stewardship. Audits provide transparency and prove compliance and accountability. To that end, many nonprofit organizations rely on modern financial management solutions to prepare audit-ready financials and develop an expedient, cost-effective nonprofit audit process.

To find out how automation accelerates and improves the audit process, provides greater visibility, and ensures compliance, download our complimentary eBook: How to Speed up Your Nonprofit Audit with Audit-Ready Financials.

Ask the author a question or share your advice