Accountants

2019 release 2 highlight: dynamic allocations reaches a milestone on the path to a continuous close

Dynamic Allocations represents a significant milestone in Sage Intacct’s move towards the continuous close. They’re now 100% automated—saving organizations with complex allocations up to three days of time each month. That’s time that can be spent on activities that deliver more value for the organization, including oversight, analysis, and strategic advice.

If you’re like most organizations, you allocate indirect costs or revenue to gain a more accurate picture of performance for your departments, products, projects, funds, or other critical dimensions of your business. And, if you’re one of the more sophisticated businesses, your allocations likely involve a complex allocation model built into a spreadsheet, multiple allocations steps, annoying adjustments (due to late information), and complicated reporting when you want before and after views of indirect costs and revenues.

Over the last few releases, we’ve been quietly releasing new indirect cost and revenue allocation capabilities. So, let’s get you up-to-date.

Eliminate Manual Gathering of Source Data

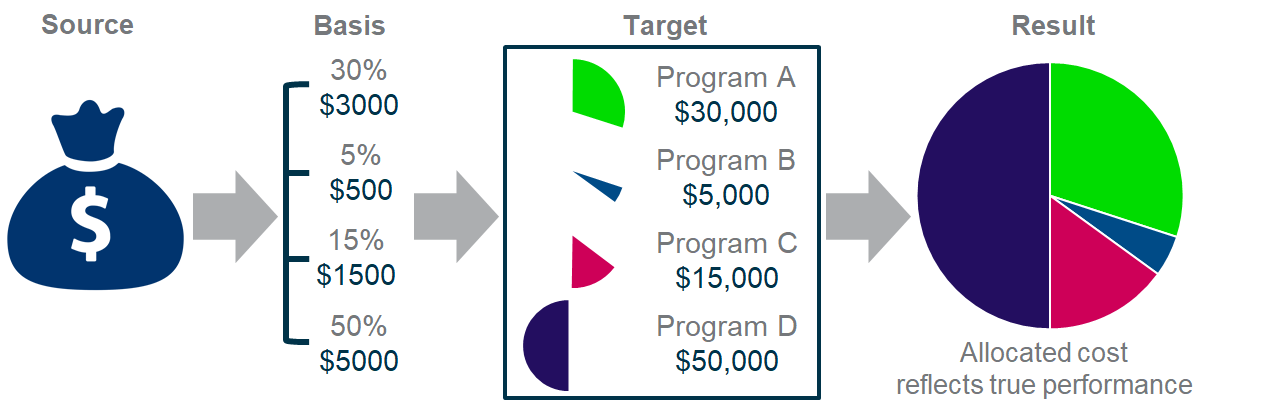

Dynamic Allocations gathers source data for you. You point it at the accounts and dimensions for your indirect costs and revenues, and each period, the data will be gathered automatically for input into your allocations. You no longer need to comb through your accounts and dimensions to get balances and enter them into your spreadsheet.

Ditch Complex Spreadsheet Calculations

With Dynamic Allocations, indirect costs and revenues are generated automatically once you set them up. You can specify your source accounts and dimensions, set up how your splits will be calculated, and specify which allocations should be grouped together to run in a specified order. For instance, you can separate controllable and non-controllable expenses or revenue for further downstream processing. The system automatically feeds source data into the basis calculations and automatically applies results to the targets. All information is centralized in your accounting solution, eliminating the need for outside spreadsheets. No more formula errors or copying and pasting data.

Alleviate the Headaches of Post-Period Adjustments

New in Release 2, true-ups automatically pick up those late changes to headcount, labor hours, or other allocation basis factors that require manual corrections. Now, that late timesheet doesn’t require you to perform a manual adjustment. Unlike most allocation solutions, the automatic reversal and the correction in Dynamic Allocations happen at the same time. That means you get continuous adjustments. And your year-to-date indirect costs are always based on the most accurate amounts available.

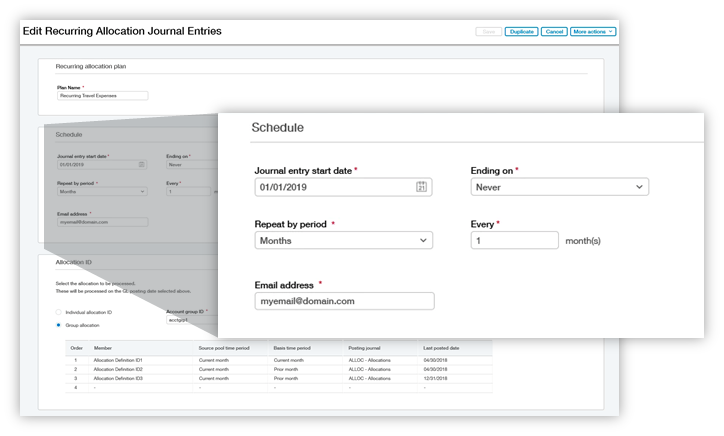

Go Completely “Hands-Free”

All of the above, as of Release 2, can be set up as a recurring or scheduled allocation. That means you don’t need to lift a finger to run your allocations after the initial setup. You just need to monitor them to make sure they’re running correctly and update with any changes to your accounts or allocation strategy.

Automate Billing on Indirect Costs

New transaction rules allow you to automate project-based calculations for posting to the general ledger and flag transactions for automatic invoicing. You can enable cost plus billing based on layered indirect costs with an additional markup for automated cost-plus billing. Sage Intacct is the only mid-market cloud financials solution to offer this capability.

Streamline Audits and Troubleshooting with Transparent Allocations

Using the same allocation definition and sequencing means that your allocations are done consistently every time. Allocation logs allow you to track success or failure and make the necessary corrections—resulting in more consistency and fewer errors.

Dynamic Allocations enables you to document your rationale, so later you can see why the allocation was set up the way it was. You can also document the methodology that you used, to understand how the allocation rationale is applied. A verification page, unique to Sage Intacct, provides complete transparency with a snapshot of parameters at the time of the allocation run. Since all information is available in your accounting system, it’s easy for you and your auditors to find the details needed to audit or troubleshoot allocation entries.

Simplify Reporting and Analysis

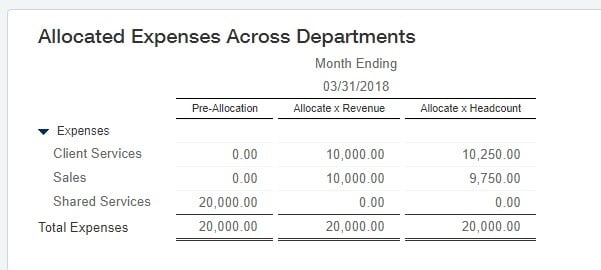

Sometimes you want to view financial information with indirect costs and sometimes without. Other accounting solutions require complex setups or reversals to retain before and after allocations views of your financial information. Dynamic Allocations uses our innovative allocations books to provide a simple, clean way to report before and after allocations. You can factor multiple books into your source and basis calculations and maintain the allocation books on an ongoing basis. For instance, you can run a report to view your department costs before allocations are applied. Then with a press of a button, you can add allocation books to see your fully loaded department costs. No additional manipulation is required.

You can also use allocation books to take your analysis a step further by easily comparing different allocation drivers for the same period, expenses, and revenues. Simply allocate using a different calculation basis into separate allocation books.

Dynamic Allocations free you from time-consuming operational tasks, so you can perform higher-value activities. You can make sure you’re executing the most accurate allocation strategy to better understand profitability—or apply the time to other activities that help guide business growth.

If your allocations are taking more time than you’d like each period or you’re interested in moving towards a continuous close, talk with your Sage Intacct Customer Account Manager or your channel partner for more information.

Release 2 delivers additional enhancements to save time and reduce risk in your business across bank reconciliations, project billing, revenue recognition, inventory replenishment, Action UI, prebuilt dashboards, and more.

If you’re a Sage Intacct customer, you can learn more in the Sage Intacct 2019 Release 2 Release Notes within the system. If you’re not yet a customer and would like to learn more, contact us at 877-437-7765 or attend a coffee break demo.

Ask the author a question or share your advice